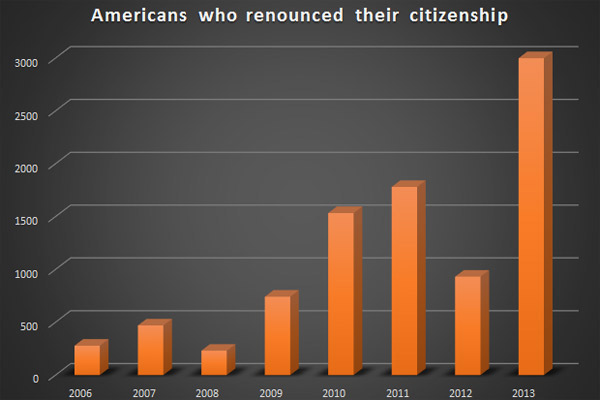

According to data from the US Treasury Department, 2999 citizens gave up their citizenship status in 2013.

Only 932 did so the previous year with the lowest figure 231 recorded in 2008 over a period of five years.

Critics link the record breaking jump to the new laws that require citizens living outside the country to file their tax returns annually.

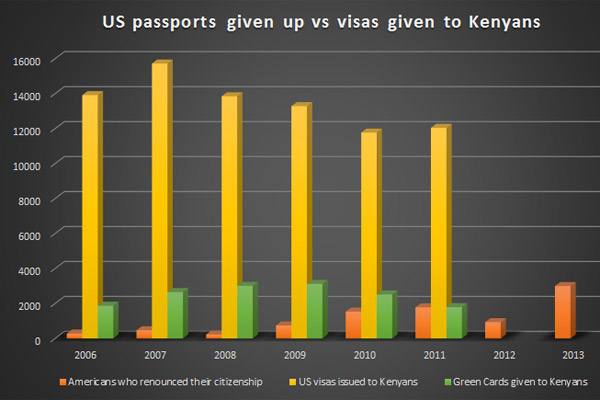

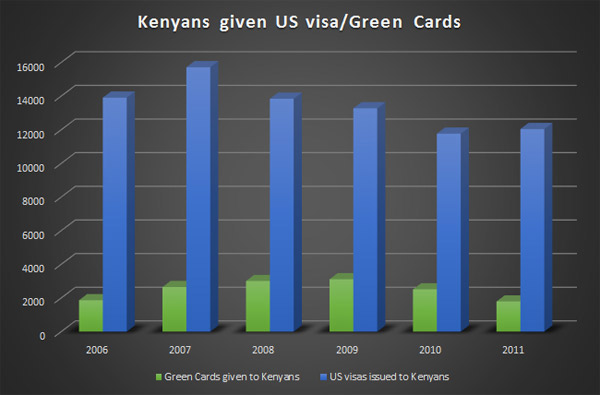

In 2011, the number of Americans who gave up their citizenship was almost equal to the number of Kenyans given Green Cards.

KENYAN TAX LAW

Kenyans living abroad are also required to pay taxes on their income regardless of its source or country of origin.

The law also provides for relief through tax set-off under section 39(2) where one provides proof of tax paid in another country against the same income.

However, the Kenyan Government still faces challenges in getting its citizens to remit taxes to their home country.

An average of 80582 Kenyans received US visas between 2006 and 2011 as compared to 5036 US citizens who gave up their citizenship in the same period.

The Kenya Revenue Authority recently revived its plan to tax sportsmen on income earned locally and abroad, a move that sparked protests from the athletes.

It remains to be seen whether the move will push them to emulate US citizens some of whom have no apologies to make over their renunciation.

LOSING SLEEP

Scott Schmith, who served in the 1990-91 Gulf war and has been living in Switzerland since 1993, is no longer a US citizen.

He received his Swiss passport and handed back his US one saying “it was like a load of weight off my shoulders.”

John, a 60-year-old business strategy specialist who asked that his last name not be used, toldAFP he had decided to give up his US passport after losing sleep for years over the intricate tax filing requirements Washington places on all US citizens, regardless of where they live in the world and where they make their money.

Six European countries, including Switzerland, have recently agreed to comply with the 2010 US Foreign Account Tax Compliance Act (Facta), requiring banks to report all holdings by their US clients to the Internal Revenue Service.

“Offshore tax evasion costs the US jobs and billions of dollars each year, and it puts an unfair burden on the average American taxpayer to make up the difference,” Senator Max Baucus, who chairs the Senate Finance Committee and sponsored the legislation, told the New York Times to explain why Facta was needed.-nation.co.ke/