We reached out to one of our Chama’s and had a candid interview on their experience of being in a Chama, how they conduct their meetings, what they’ve been able to achieve and how they foresee the future of their Chama. Below is how it went.

Tell us more about your Chama (Name of Chama, number of members, when it was founded, how often you meet, e.t.c).

We started off as a Chama but quickly recognized the potential of the group coming together and promptly registered ourselves as a Limited Company – Asset City. We are 10 ladies altogether, with 2 members in the diaspora. We came together in May of 2014. We meet every 2nd Saturday of the month for deliberations and group bonding.

What are some of the things you have been able to achieve in the past as a Chama?

The monthly meetings have allowed us to bond as a group.

We had a 4-hour educational session on Investment Planning with Tony Wainaina author of “Chama-to-Conglomerate” on how we can grow our Company by implementing best practice right from the start

We had an annual family fun day last year where we went out of town with our families and spent time playing and shared a meal with them as we shared with them the Company’s vision. We have another one lined up in November this year. As a result our bonding has gone beyond the group and extended to our families.

We had our first ever CSR activity where we fed over 250 children at a Children’s home in Mathare. We also carried foodstuff, clothing items, shoes e.t.c. for the children.

In one year, we have raised over KES. 3 million, which we have gone ahead and invested.

We operate a savings account with Chase bank.

We are Members of FEWA (Federation of Women Entrepreneur Associations) and we get invited to various training on entrepreneurship.

Many Chamas face a challenge in that some members are not committed. Have you faced this challenge and how have you dealt with it?

We choose to focus on the strengths each member brings and the strength in putting our resources together. We all add value in different ways, others it is in the networks they come with, others their skills and previous experiences, others the energy they bring; all these put together help us keep focused on the objectives of the Company. We also discuss issue as they come up and always remind ourselves why we came together at first and the commitment we have all pledged to see this to its long term end.

How has the Chase Bank Chama account been instrumental in helping your Chama achieve your goals?

Firstly, it is in knowing our resources are safe with a well-established and reputable institution.

Having a relationship manager that is assigned to the account makes it easier to get matters addressed.

Chase bank has got attractive interest rates for money in savings accounts.

Affiliated to Chase Bank is Genghis Capital that we are using to invest our money.

Internet banking helps us in quickly checking the status of our account.

Chase bank also comes with a variety of mechanisms dealing with customer issues – Contact Centre, Chase Whatsapp, Relationship Manager, all these make it easier to have our issues resolved promptly.

A wide network of branches across Nairobi has also proven to be quite helpful for us.

Click HERE to Find Out More About The Chama Account.

Do you engage in fun activities together as a Chama and what are they?

Yes. The are;

As mentioned above we have annual family fun days for the Company and their families. Our second one is coming up on the 21st of November 2015.

We also recognize and celebrate every member’s birthday by exchanging gifts and honoring the member.

We also celebrate each other’s milestones such as graduations; launches etc. as well as visit each other in times of illness etc.

After our meetings we usually sit and catch up with each other which is always fun.

What plans does your Chama have in the near future?

We are looking forward to our first AGM in May 2016.

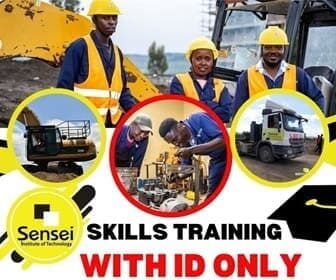

We are looking to grow our investment portfolio with a keen eye on building and construction.

Article also published on the Chase Bank Kenya blog.

For more information, Call: 0730 175 000, 0709 800 000 | Whatsapp: 0773 758 196 | Tweet:@ChaseBankKenya | Email: atyourservice@chasebank.co.ke | Skype: Chasebankkenya