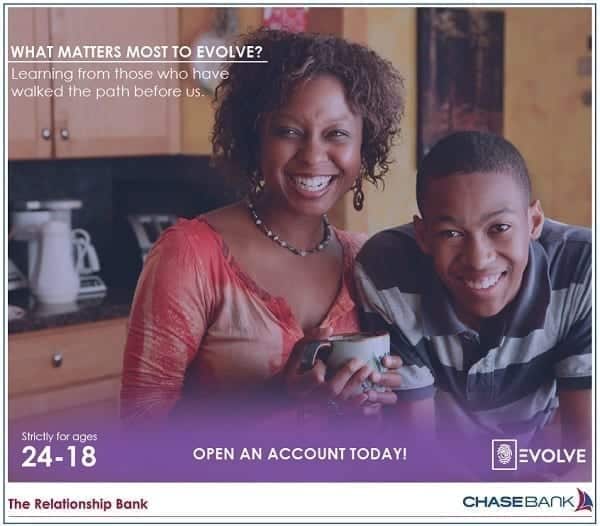

Chase Stories:When the Young Evolve: Chase Bank Kenya

At this prime age (24 – 18 years), thousands of young people are graduating out of institutions of higher learning every year with high hopes to succeed. Then they are met with the harsh environment that is made up of; tarmacking for jobs, lack of money, and stiff competition from their peers. But that’s just the tip of the iceberg, because challenges will keep presenting themselves as you jump into the different stages of life. It’s how you tackle them that sets you apart.

After tarmacking, you get into your first job (or start your business) and start earning a salary. But how do you ensure that regardless of the amount of salary you earn, that this money becomes of benefit to you than it is elusive? Here are some of the tips you can consider that will set you apart from your peers;

1) Identify your spending habits.

Most of the youth have what we may call emotional spending. Meaning that they spend their money on things they actually do not wish to spend on. Some reasons being, because;

- Their friends are spending and they want to fit in

- They want to keep up with a trend and remain cool to their peers

- Someone has asked them to with the classic, ‘do you have 500 bob?’

- They can. You just spend because you have the money

As a youth, you must always resist the temptation of emotional spending because after you spending your money, you may start regretting why you had done so instead of investing your money into something profitable. Emotional spending is a sign of financial indiscipline and should be avoided as much as possible.

2) Budgeting for your money.

It is a trait that we ought to learn at a while still in our youth. Budgeting means that you’re organized, disciplined and most importantly, that you know exactly what you want and what you are supposed to do. Failing to budget makes you spend on anything and everything that comes your way with no plan, which in turn leaves you frustrated, and with no money when you actually need it.

3) Start investing the little you have.

The truth is that money multiplies only if invested through the right channel, at the right place and at the right time. Most people usually think that one can only start investing if he or she has a lot of money and they fail to put into consideration that a ‘journey of a thousand miles starts with one step.’ Make an effort today to invest that little money that you have today. It could actually be the stepping stone to the world of millions.

Chase Tips and Tricks

As a youth aged between 18 to 24 years, and you’re experiencing many of your firsts in the grown-up world, we encourage you to transact and save wisely by;

Opening an Evolve Account. This is a current account that enables you to transact whenever you need access to your money. Besides owning an ATM Card, you can also download the Mfukoni App and make Mpesa transfers directly from your bank account and vice versa.

Opening an Origins Savings Plan Account. This account helps you put some money aside that you can access in the near future (you can select a tenure for one, two or three years). During this time, you’ll earn an interest on the money and you can get a loan (of up to 90% of your savings). Your savings play a big role in enabling you to achieve the things that matter to you. Whether it’s a house, a piece of land, a car, a beautifully furnished house, a vacation or growing your business.